Years ago I worked in the Financial Service industry. I worked for three different Credit Unions and came across data issues constantly. Sometimes it was as simple as a check that was unable to be deposited because the spelling of the name was incorrect, or it was made out to a business name rather than the owner. Other times it was as serious as an individual’s credit being ruined because they had the same name as a relative and the credit reporting bureaus recorded the relative’s loans and late payments on their credit history instead. On a side note cleaning up those incorrectly reported credit errors is very difficult, but has gotten easier, primarily because identity theft has become more frequent in our society due to that credit problems are more common. I think everyone can think of a reason why it’s important for a consumer to have correct data, but it’s not always clear why businesses need to make every effort to keep their data clean and free of errors.

Data errors can affect any aspect of business. Everything from product stock, to financial numbers, to marketing effectiveness is tracked with data. If any of this data is figured incorrectly serious issues arise. Companies need to evaluate their systems and find the areas that are most vulnerable to data errors. One major area is Customer information. Unlike other areas, customer data is constantly changing, addresses, phone numbers and credit card information are often needing verification and updating. These are some of the most difficult areas to keep correct, because unlike data that a company provides, these types of data are completely reliant on outside sources. Businesses need to have the right tools in the hands of the right individuals to decrease the frequency of inaccurate data across every area of business.

For years Scion made money and did decently. In 2007 the economy took another tumble. The middle class got hit really hard. This caused Scion to lose more sales because their target demographic took the biggest hit financially because of the economic down turn. Eventually Toyota, by teaming with Subaru to build the FR-S/BRZ, strived to change public opinion of Scion as a small inexpensive car brand for the 20 something crowd. Even after these efforts Scion failed to see much improvement in sales. While no company can see the future, if Toyota had collected more data, and adapted Scion’s business plan to include a small SUV when gas prices started to drop, or planned on adapting their small cars to accommodate two adults and a child seat comfortably, then they may have been able to increase their market share in the US. In the end Toyota chose to cut their losses and move on.

For years Scion made money and did decently. In 2007 the economy took another tumble. The middle class got hit really hard. This caused Scion to lose more sales because their target demographic took the biggest hit financially because of the economic down turn. Eventually Toyota, by teaming with Subaru to build the FR-S/BRZ, strived to change public opinion of Scion as a small inexpensive car brand for the 20 something crowd. Even after these efforts Scion failed to see much improvement in sales. While no company can see the future, if Toyota had collected more data, and adapted Scion’s business plan to include a small SUV when gas prices started to drop, or planned on adapting their small cars to accommodate two adults and a child seat comfortably, then they may have been able to increase their market share in the US. In the end Toyota chose to cut their losses and move on.

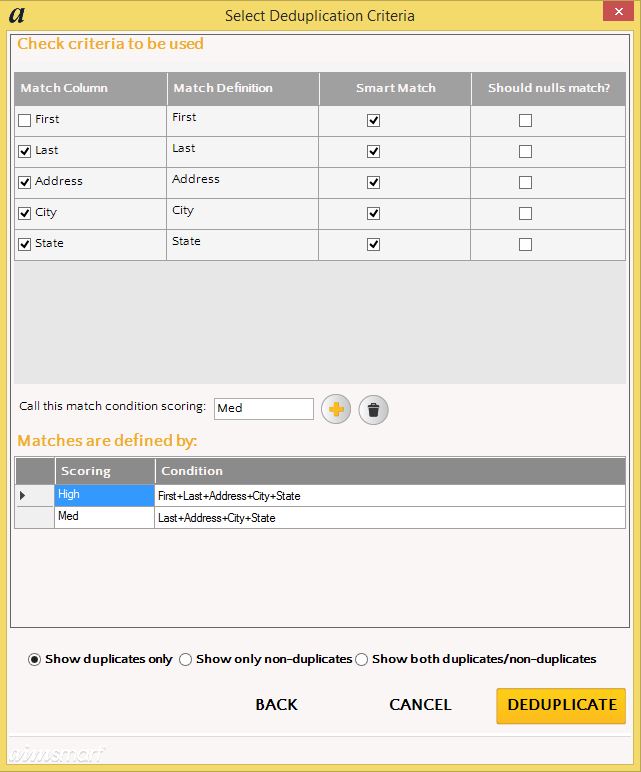

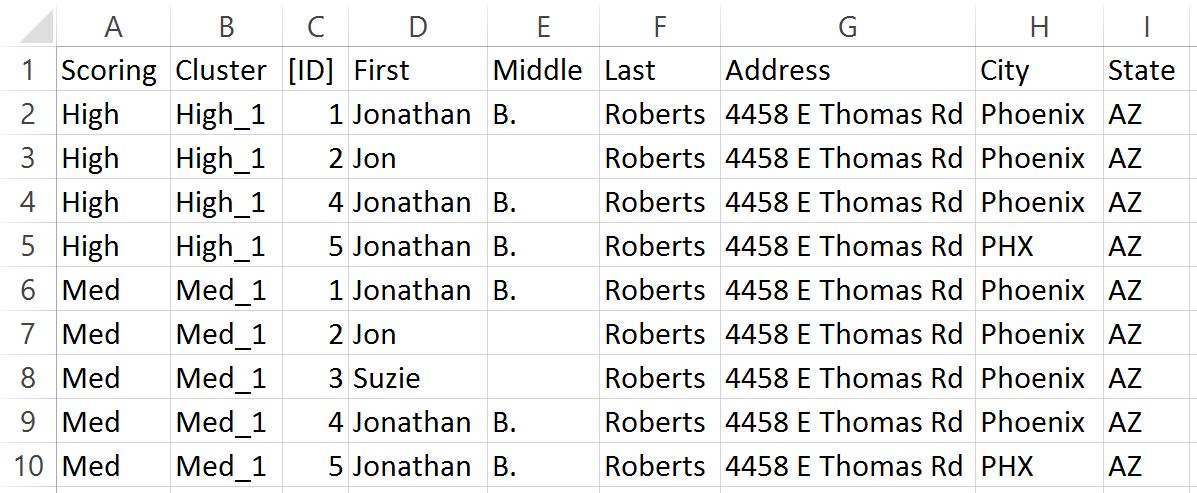

Our team at Aim-Smart is excited to announce that after diligently working over the past months, Aim-Smart is fully compatible with Microsoft Excel 2016. With the updated version users are able to take the well-known abilities of Excel to the next level. By adding Data Quality features from Aim-Smart. Excel 2016 is enhanced with the tools any business user needs to deal with large data sets. Thanks to features that include the ability to fuzzy match entries, and process high level deduplication, Aim-Smart really boosts the abilities of Excel 2016. Optional features also enable users to do address verification with in Excel 2016. For more information about address verification using Aim-Smart in Excel read our blog post

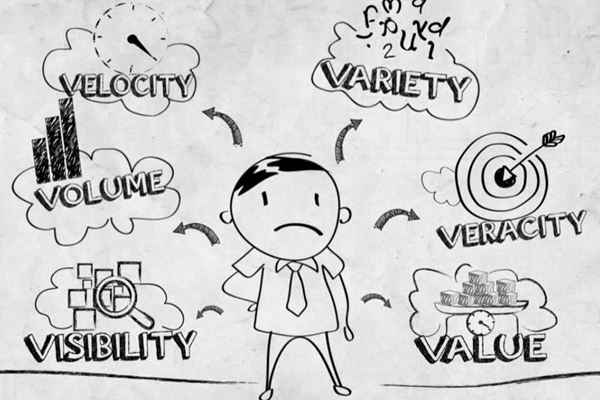

Our team at Aim-Smart is excited to announce that after diligently working over the past months, Aim-Smart is fully compatible with Microsoft Excel 2016. With the updated version users are able to take the well-known abilities of Excel to the next level. By adding Data Quality features from Aim-Smart. Excel 2016 is enhanced with the tools any business user needs to deal with large data sets. Thanks to features that include the ability to fuzzy match entries, and process high level deduplication, Aim-Smart really boosts the abilities of Excel 2016. Optional features also enable users to do address verification with in Excel 2016. For more information about address verification using Aim-Smart in Excel read our blog post  Big Data is defined by three aspects, Volume, Varity and Velocity. Volume is the amount of data that is being analyzed, Varity is the number of fields of within the collected data. Velocity relates to the speed at which data is being collected, real time data collection is becoming more and more common. While all these things would be very useful to most businesses, the reality is, most businesses don’t have the financial ability to collect and process this much data. In addition many businesses don’t require Big Data to thrive and grow in their marketplace.

Big Data is defined by three aspects, Volume, Varity and Velocity. Volume is the amount of data that is being analyzed, Varity is the number of fields of within the collected data. Velocity relates to the speed at which data is being collected, real time data collection is becoming more and more common. While all these things would be very useful to most businesses, the reality is, most businesses don’t have the financial ability to collect and process this much data. In addition many businesses don’t require Big Data to thrive and grow in their marketplace.

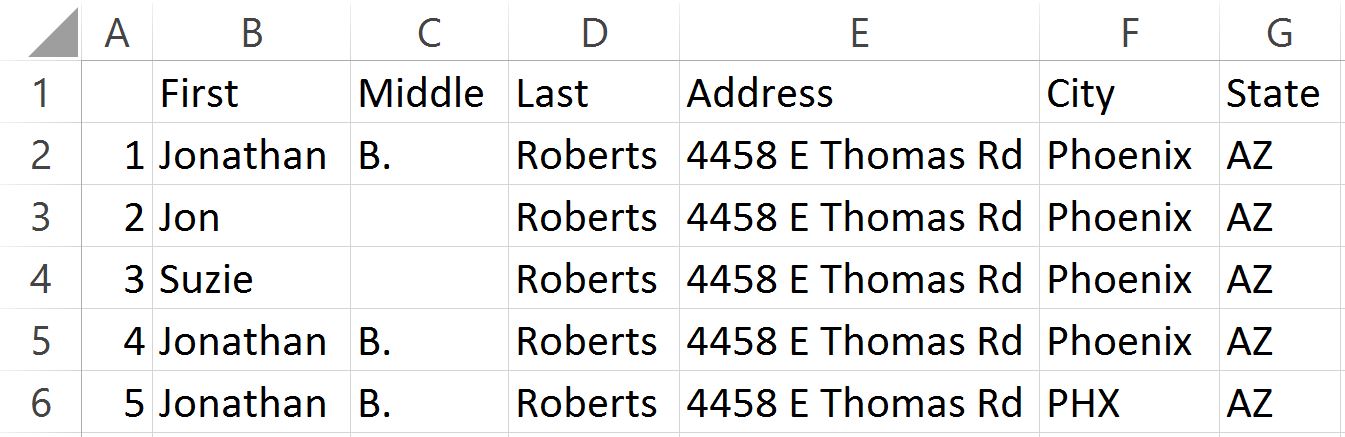

With the New Year upon us it is a great time to assess where business can become more efficient. The ability business has to process analytics is expanding faster and faster. Thanks to modern computers and advanced software, interested parties can collect and evaluate more customer data faster than ever before. Businesses have to be cautious though. There are holes that cause issues with the results data supplies, if that data isn’t as correct as possible. Since the economy crash a few years ago, an increasing number of customers have rapidly changing information. Many people who were once home owners, now rent, and move with increased frequency. Many are changing phones plans and phone numbers. Others are getting married or pass away. There are far fewer constants today than in the past. As companies collect more data, it becomes more difficult to verify if their data acquired in the past is accurate. This creates multiple records for the same customer with varying levels of accuracy. These records not only fill up company databases, but keeping incorrect data wastes company resources. Large companies employ professional companies or firms, or they use department resources to monitor their data to and remove inaccurate information.

With the New Year upon us it is a great time to assess where business can become more efficient. The ability business has to process analytics is expanding faster and faster. Thanks to modern computers and advanced software, interested parties can collect and evaluate more customer data faster than ever before. Businesses have to be cautious though. There are holes that cause issues with the results data supplies, if that data isn’t as correct as possible. Since the economy crash a few years ago, an increasing number of customers have rapidly changing information. Many people who were once home owners, now rent, and move with increased frequency. Many are changing phones plans and phone numbers. Others are getting married or pass away. There are far fewer constants today than in the past. As companies collect more data, it becomes more difficult to verify if their data acquired in the past is accurate. This creates multiple records for the same customer with varying levels of accuracy. These records not only fill up company databases, but keeping incorrect data wastes company resources. Large companies employ professional companies or firms, or they use department resources to monitor their data to and remove inaccurate information.